You can try all of the mortgage marketing ideas you want but the mortgage market is famous for booming and busting with economic cycles.

If you’ve been around long enough, you remember the Savings and Loans crisis of 1996, and even if you weren’t in the mortgage industry at the time, you felt the mortgage meltdown of 2007-2008.

And now in 2023, we are experiencing ongoing banking turmoil and mortgage rate volatility.

Why am I leading with panic scenarios? I want you to feel the urgency of upping your mortgage marketing game.

Developing a strong mortgage marketing plan is the best way to smooth out the volatility in the mortgage market (even taking advantage of panic scenarios) and keep your business steadily growing as others struggle.

The following are 30 mortgage marketing ideas you might have not tried yet. These tactics can easily layer into your current marketing program.

Buying internet leads has never been easier. Shop now.

1. Add an email signature to all of your emails

Start using your business email as your primary email and add an email signature that clearly explains the mortgage products you have to offer.

Now, when you’re sending emails back and forth to friends, family, fantasy football leagues, soccer and baseball teams, band boosters, church groups, and community activities—you’re marketing!

2. Make an everything-we-sell sheet

People love to browse the menu and ask about new things.

No matter how thorough we are in servicing our book of business, there is a good chance we will stumble across a need that you offer, but that the client doesn’t know you offer.

Send this sheet out at least once a year. You never know when someone is thinking about refinancing, buying a second home, downsizing, or taking out a home equity loan.

3. “Put me in your phone”

You’ll be shocked at how willing people are to do this.

Tell them to label you on their phone as “the mortgage person.” Then remind them that the next time someone asks about buying or selling a home they can impress them by texting “their mortgage person.”

4. Get a website or freshen up an old one

Websites are the modern storefront and yellow pages.

Whenever anyone is looking for anything, you can bet that the first thing they will do is Google it.

So, if you don’t have a website—you’re missing a lot of business.

And, if you do have a website and it doesn’t look like anyone has looked at it since the ’90s, that’s just as bad. You know the ones that look like these classic designs that now hang in the “Gallery of Web Design History.”

Partner with a digital marketing agency or hire an in-house web developer and designer to revamp your website. It’s truly one of the most important investments you can make for your business.

5. Find your niche

Your “niche” includes your target audience who would benefit the most from your products and expertise.

Deciding on your target audience doesn’t mean you’re excluding other groups of borrowers. Instead, it allows you to use your marketing resources more efficiently.

From there, you can identify specifics about these groups of people, including their unique questions and pain points.

To identify your niche, determine who can benefit the most from your services, the locations you’re targeting, any specialty products you offer, and what makes you different from the competition.

6. Write on your blog

Many home buyers are looking for answers. You have a wealth of knowledge you could share, such as what to expect from the mortgage process and how to choose a broker.

You can establish trust and familiarity by educating customers even before you make contact.

If you’re not sure which information to share, start keeping track of the questions that new prospects and customers are asking when you meet for the first time.

Make your website or blog the go-to source for these frequently asked questions.

7. Go Live on Facebook

Another great place to educate customers is on Facebook.

You can, of course, do a Facebook post on your Page, but I’ve found that going Live and posting that quick video is the best way to engage and grow your audience of potential customers.

Cover the same content as you would on a blog: Answer commonly asked questions, react to recent industry news, and cover topics, such as improving credit, which always draws in curious customers.

8. Make videos

86% of marketers use video as a marketing tool, and the same percentage believes that video is successful in generating leads.

In 2023, online video is expected to make up 82.5% of all web traffic.

How do you leverage these statistics as a mortgage professional? Just start creating!

Today, it’s as simple as propping up your phone, recording yourself speaking in a well-lit area and posting the videos on YouTube or your other social media channels.

Mortgage marketers have to play the long game due to the nature of the beast — especially during periods of rate volatility and high home prices.

Creating consistent video content allows you to generate and convert more leads by building trust and rapport with your audience. It helps to see your face and get to know you, as well as helps the audience retain more information.

Plus, video is fun to share on social media.

Consider the following video topics:

- Educate the audience on mortgage topics

- Break down complex topics, such as reverse mortgages

- Explain the mortgage process and documentation borrowers need

- Offer advice

- Dig into news topics and offer your unique opinion/perspective

Make sure you come across as friendly and approachable in the videos so your audience will want to work with you.

Take a look at the video below from mortgage lender Jennifer Beeston, who has more than 50,000 subscribers and 11 million total views on her YouTube videos.

9. Post on community forums

Have you ever typed a question into Google and the first results were content from Quora or Reddit?

These community forums are extremely popular sources of information.

To establish yourself as a well-rounded mortgage expert, create accounts for online forums and search for mortgage questions.

Answer the questions thoughtfully and completely, and make sure to include your credentials (Quora has a space for this in your profile).

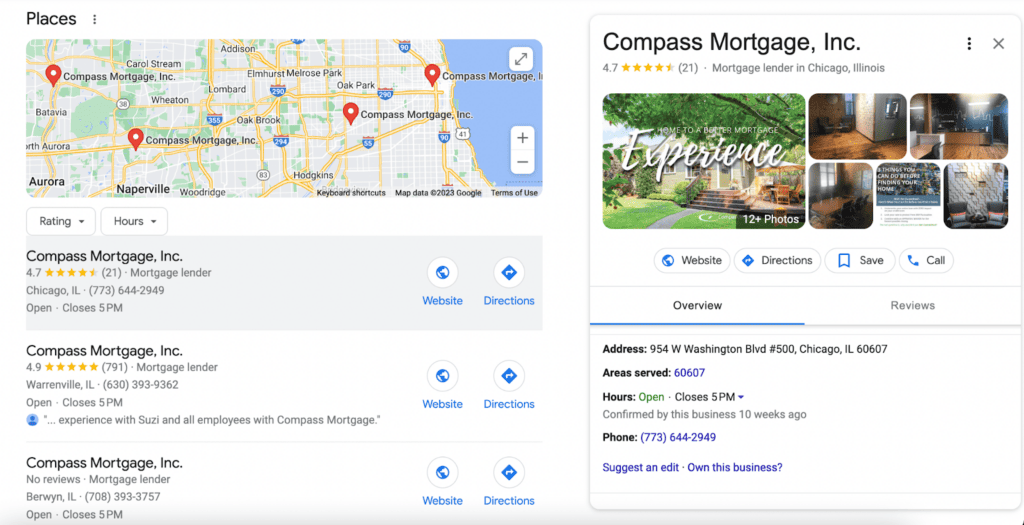

10. Complete your Google Business Profile

A Google Business Profile is an underrated marketing tool that drives local business to you.

The key to making your Business Profile the most powerful? Fill it out completely — and keep it up-to-date.

Include essential information such as your business name, phone number, address, open hours, and website, and beef up your profile with photos, reviews, and a list of your services.

If you include your unique products or services such as 2-1 buydowns, reverse mortgages, or VA loans, you’re sure to jump to the top of the search when local prospects type in these keywords.

Remember to note in your calendar to update and add to your profile frequently. I don’t know about you, but I’ve fallen victim a couple of times to a business that moves but doesn’t update its address on Google.

Compass Mortgage’s Business Profile includes all relevant contact information plus photos, reviews, and a statement from the company explaining what they do, how they do it, and their top priorities.

11. Teach financial advisors about mortgages

Financial advisors are one of my secret weapons.

They spend a lot of time doing deep dives into people’s finances and are trained to help people save and invest money. They’re also usually well-versed in insurance products to help protect against catastrophe and protect those savings and investments.

But, they are notoriously uninformed about what tends to be the biggest asset in their clients’ portfolios — their home, and more specifically their mortgage.

This section isn’t a dig on advisers, but it is a big blind spot for these smart professionals.

Here is the win-win offering: By teaching advisors a thing or two about mortgages you can help them ensure that their clients aren’t wasting money on higher-than-necessary mortgage interest, PMI, homeowner’s insurance, or property taxes — adding to the funds that the advisor can place under management. And you get referrals!

12. Write guest posts

Guest blogging is beneficial for multiple reasons:

- Builds credibility and trust

- Drives traffic to your website or social media

- Boosts lead generation

- Offers a backlinking boost (good for SEO)

Start by deciding your ultimate goals with guest blogging, so you can make sure you’re creating the right types of content for the right audiences.

You’ll then want to choose the sites to contribute to, get to know them, and pitch your content.

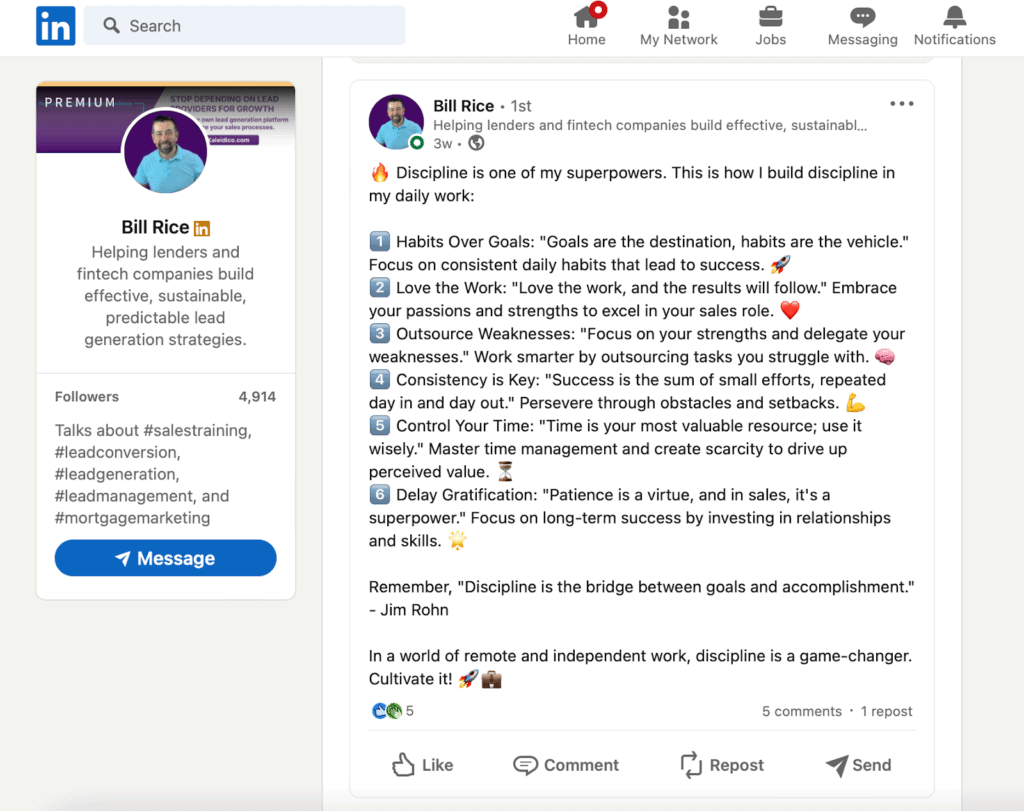

One of the best ways to network and build relationships with fellow mortgage professionals is via LinkedIn, which brings us to our next idea.

13. Create a LinkedIn account

LinkedIn is where business professionals hang out.

What began as a website for professionals to post their resumes for employers has turned into a 930 million-user platform.

To get started, create your profile and search for people you know and/or top professionals you admire, including other mortgage lenders or brokers, real estate agents, and financial advisors.

Start crafting and sharing your own thoughtful content, including unique industry perspectives, inspiration, and company research.

Make sure you share and interact with others’ posts, including “reacting” to the content with a thumbs up or sharing it on your own feed.

14. Post regularly on social media

You don’t have to dominate every single channel or post three times a day every day — just post consistently and regularly to keep the channels your audience uses fresh and up-to-date.

Post photos, videos, infographics, blog posts from your website, or a quick news link with your thoughts on how it impacts your audience.

Again, going back after your post and interacting with comments is a major way to boost engagement on your pages. Don’t leave your visitors hanging.

15. Send out home maintenance tips

One of the best ways to keep in contact and add value is to educate your book of business.

Considering that all of your prospects have a home — owned or rented — you can add a lot of value by educating them on how to best maintain their home.

Remind them to change the batteries in their fire alerts so they don’t get that dreaded low battery chirp. Teach them how to change HVAC filters, prevent dangerous lint build-up in dryers, or check for leaks in aging washer hoses.

The tips and tricks you can share about homeownership are nearly limitless.

Buy aged leads and fill your pipeline with prospects already asking for a rate quote.

16. Wrap your car

You’re probably claiming some part of your vehicle as a business expense. Why not leverage your vehicle by making it a mobile billboard?

Wrapping your car is a great way to get your face and brand in front of everyone in your community.

17. Buy mortgage leads

We’re not all marketing wizards. One of the easiest ways to fill your sales pipeline and keep focused on selling is to outsource the marketing to professionals.

Buying mortgage leads is the simplest way to jumpstart your mortgage marketing.

There are hundreds of internet mortgage lead providers. Take some time to try a few providers, with small tests, and see if internet mortgage leads are a good fit for your mortgage business.

18. Buy aged mortgage leads

Real-time mortgage leads can be expensive, and many of them don’t convert quickly for a variety of reasons.

However, most leads do close — just not necessarily on the first call or even in the first month.

Statistically, 45–48% of mortgage leads that do convert often convert weeks and months later — these are aged mortgage leads.

This behavior creates an opportunity to not only save a fortune on leads but also try internet leads for a few hundred dollars a month instead of a few thousand.

19. Sponsor and attend local events

So much marketing is just getting your logo and face in front of as many people as possible, in the best possible context. That is why sponsoring and attending local events is a great strategy.

For relatively small investments and the cost of a bunch of company T-shirts, you can show off your commitment to your community.

20. Teach Financial Peace University or other personal finance courses

Teaching and educating consumers is always a smart way to generate referrals and bring yourself a better client — one that is financially prepared and well-qualified for a mortgage.

Financial Peace University and other similar courses are a great way to add value and improve people’s lives long before they become a client.

21. Educate people on how to improve their credit

Credit is often the biggest hurdle for borrowers.

Offering credit education through email, Facebook Live, webinars, or even a partner is a great way to provide value and develop well-qualified borrowers from leads you’re nurturing.

22. Get yourself on billboards

Billboards are a great way to etch your brand into the minds of commuters and residents.

You probably have never considered this because you assume it requires big budgets. But, there are cheap but effective opportunities for buying remnants or gaps as advertisers rotate on billboards.

23. Teach clients how to generate referrals

Don’t be shy—ask clients to refer you.

Train and remind your clients how to refer you to new clients. After all, if they care for their friends and family why would they risk them going to an incompetent mortgage broker?

Create a referral plan that includes in-person requests following a positive interaction and requests for referrals via social media and email from past clients.

24. Update your email strategy

With email marketing, you can keep potential customers informed about changes in the market, rates, news, and tips — all while they continue their home search, investigate refinancing, or are even out of the mortgage market from time to time.

Email is as powerful as ever for staying top of mind with your book of business, but too often we neglect to consistently and frequently send valuable emails to customers.

25. Start an email newsletter

Email newsletters are an excellent way to connect with past, current, and future leads by reporting the latest industry news, products, and resources.

A newsletter is your space to connect with your audience directly in their inboxes. Include a news rundown, highlight your recent blog posts, toss in a video or two, and schedule it out.

You can send one out weekly, monthly, or even daily, depending on your capacity and your audience’s wants and needs.

26. Gather and promote customer testimonials

Your satisfied customers are a fantastic asset that could help you promote your business to future customers.

Make a habit of asking your current customers for feedback on their mortgage experience and create a feedback collection system that’s easy for customers to use.

A simple online form or a link to your preferred review site are both excellent options.

Another tip is to ask for a review shortly before or just after their closing date. The experience is fresh in their minds, and they’ve just given you their business.

Encourage happy customers to leave a review on Google, too, which will help you bulk up your Business Profile.

Pro tip: Respond to every review to give your profile an extra boost.

You can show your appreciation for their feedback with a thank-you card or small gift.

27. Monitor your reviews

What are people saying about you?

In a digital world, we have to stay on top of what people are writing about us on the web. Reviews hold a lot of weight — most people give them as much weight as a friend or neighbor’s opinion.

Of course, you’re going to put your best foot forward in all client interactions, but sometimes no matter what we do someone has an issue. If that happens to you, just be proactive and respond immediately.

28. Get involved in your community

Trust, familiarity, and shared interests are opportunities to connect with your prospects and close sales with your customers.

You can build trust and establish connections during your client consultations and through your marketing, but community involvement lets you take it a step further.

Get involved with passions and projects individually—participate in charity events, and neighborhood civic groups, get involved in sports, or hobby communities.

You can also get your organization involved as well—sponsoring charity events or a community little league team, or creating a local scholarship prize.

Any of these events will get you big points with your community. Become known for being involved as well as for your profession, and when folks need a mortgage, they’ll come to find you.

29. Work your network

You know more influential people than you think you do. Your friends, neighbors, church, and more can all be yet another source of potential customers and referrals.

Your customers value trustworthiness and connection, and there’s no reason you can’t start building those relationships before you become a broker and customer.

And for referrals, a recommendation from a personal friend has a strong influence over your potential customers. Likewise, connecting with your network can complement your community involvement.

30. Use the news

One of the most common excuses I hear for not marketing is: “I don’t know what to talk about.”

Just tune in to the news, and you’ll have unlimited talking points.

The mortgage market, which is impacted by real estate, interest rates, the stock market, the unemployment rate, consumer confidence, and any other kind of economic news you can think of should give you a ton of things to talk about.

Watch CNBC for an hour, and you’ll have a half-dozen, “the sky is falling” news stories you’ll need to alert your client database about.

It’s that simple. Watch the financial news channels, browse your news feeds, and visit a few of your favorite industry news sites and you’ll have a few links that you can pass along to help your clients every week.

Get started!

Before I leave you with all of these great ideas, I want to strongly encourage you to take at least one or two of these and do them today.

Managing and working a database is the secret to building a long-term, sustainable business that will support you through any market—good or bad.

Build out your database by purchasing aged mortgage leads from Aged Lead Store.

For a few hundred bucks you can add hundreds of customers that have inquired about a mortgage within the last couple of months. Treat them like clients, and they will become your clients.

Happy selling!